Our Mission

Skytian builds generational wealth for our families and partners by systematically identifying and investing in assets with the best risk-adjusted returns.

Founded in 2000 and celebrating our 22nd year in 2022, we have deployed US$600 million+ of capital across multiple asset classes in US, Canada, China and Asia. We are proud to have created sustainable wealth for our capital partners while creating jobs and improving communities.

Our Team

Our team has managed billions in capital and deployed US$600 million+ across multiple asset classes in US, Canada, China and Asia through all market cycles.

What does Skytian mean?

天 or “tian” means “sky” in Chinese.

At Skytian, we are global citizens and students of life and investing, we set and achieve Heavenly goals while adhering to our Core Values.

Our Core Values

TEAM

San Eng, Founder & Chief Investment Officer

San is an “Investorpreneur.” As an investor, San has managed billion-dollar funds and deployed US$500+ million in the technology, infrastructure, consumer, blockchain, agriculture, and real estate sectors in the USA, Canada, and Asia. San’s private equity firm has been ranked Top 30 and Top 50 in China. As an entrepreneur, San has founded and led ventures raising $150+ million. He has sat on Boards and advised CEOs and founders of three dozen companies. San’s work has helped to create thousands of jobs. In real estate, Skytian has invested hundreds of millions of dollars in single-family homes and condos, farmland, mortgage funds, retail/commercial, and multifamily apartments in North America and Asia.

San’s ikigai (reason for being) is his family. A devoted father to three daughters, San is committed to education. He has taught investing as an Adjunct Professor at prestigious universities, served on Boards of institutions such as the Wharton Alumni Association, and invested in education ventures, such as Wizards Institute which teaches smart investing. San is the co-author of the Wall Street Journal and USA Today best-selling book, Ten Commandments of Investing.

Mentors

- Known as “The Apartment King”

- Invested 5,000+ units across America

- Personal Mentor to San & Oia Eng

Brad Sumrok

Partners

- Owned/managed/operated over 2,370 doors of apartments

- Experience with stabilized and development projects

- Professional engineer

Brent Ritchie

- Invested and manages 500+ units

- Former real estate private equity Vice President

- Integrated property management firm

Anthony Scandariato

- Invested 500+ units

- Founder of four (4) technology and growth firms

- Naval Officer

Joshua Awad

Team

STRATEGY & PORTFOLIO

Strategy

What We do

We are commercial real estate investors acquiring well-located apartment and mixed-use properties in the top-performing cities where we can add value and increase rents through physical upgrades and improved property management practices. Skytian also actively invests in select Sponsors with similar strategies particularly in top markets we are not yet active in.

Our Advantage

We have 21 years of experience and a track record of investing in real estate and diverse asset classes in multiple countries through all economic cycles. We review hundreds of properties each year and only invest in those few that meet our stringent safety, yield, and equity growth targets. We employ advanced underwriting techniques to determine the underlying value of each property and utilize our market knowledge. This often enables us to see opportunities where others do not. Our exceptional due diligence process is designed to eliminate as much risk as possible before we offer it as an investment. We only acquire properties in which we are confident we can increase the value.

Our Investment Criteria

Skytian has clear, compelling, and proven criteria for investing.

We invest only in Rising Tide markets with local advantage:

- Top 5 USA growth (jobs, population) markets – today to next decade

- Organic rent growth of high single and double digits per year

- Favorable tax treatments at the city, state, and asset levels

- Friendly landlord rules e.g. zero to limited rent controls

- High barrier-to-entry markets priced well below replacement costs

- Household income above $45,000 and rising, below-average crime rates and improving, no high-risk flood zones

- “Boots on the ground” with local Rockstar team of sponsors, brokers, lenders, legal and other partners

- Our core markets evolve with market conditions and currently include Central Florida, Texas, Carolinas, and select Northeast cities

We are targeted and highly selective of the asset class:

- Class B and C multifamily apartments only

- Stabilized (typically 90%+ occupancy) and diversified rent rolls

- Average in-place rents at least 5%-10% below market

- Single assets with 100+ doors or $10 million+ purchase price or smaller assets clustered in the same market for economies of scale

- Attractive opportunities for value add and favorable tax treatment

- Ugly Ducks (e.g. Class B in B+/A- neighborhood)

- Clear and compelling physical, operational, or financial improvement areas can be captured through superior management

We aggressively add value:

- Rehab and improve interiors and exteriors where every $1 spent yields at least 3x in asset appreciation

- Reposition and rebrand assets for optimal tenant mix and higher rents, supported by asset improvements and market trends

- Creatively increase other incomes such as washers & dryers, pet fees, smart home systems, valet trash, covered parking, and so on

- Reduce utilities e.g. separating meters, water conservation, and RUBS programs

- Minimize financing costs through refinancing and superior loan programs

- Partner with best-of-breed Property Management firm to implement value-add program and asset management

We adhere to strict financial and returns parameters:

- Immediate positive cashflow projects with 7%+ average cash-on-cash returns

- Overall project returns of 15% IRR or higher

- Target 3-5 year holds or longer with potential to return all or material part of investment equity through post-value add refinancing

- In-place 90%+ occupancy that withstands economic shocks (e.g. COVID, long-term economic downturns) – an “all-weather” asset

Our Process

Skytian follows a 5-step process to acquire and generate value:

Acquisition

Reposition

Rehab interiors/exteriors & re-brand property to attract higher quality tenants and higher rents.

Refinance

Have property re-appraised, which capitalizes on newly created value, and returns a significant piece of investor’s capital.

Cash Flow

Put in place our or third-party property management team to continue daily operations, while investors enjoy a high-yielding tax-efficient asset.

Disposition

Sell asset at an increased price due to forced appreciation through value-add enhancements and enjoy profit (if decide to dispose – or hold for long-term cashflows).

Portfolio

Below are select portfolios Skytian has invested in the past 18 months:

Clearwater Oasis

Coconut Villas of Dunedin

Swartswood Manor

Oia Building

The Westchase

76 doors | Tampa, FL

20 condos | Tampa MSA, FL

64 doors | Newton, NJ

5 units | Belleville, NJ

1,330 doors | Houston, TX

Merged two adjacent assets with cost synergies and deep value-add. In the first 5 months, increased average rents 27 (vs 15% proforma) on 25 units renewed or released spending only 30% of CAPEX budget

Acquired 100% of 20 condos, individually parceled. Re-leasing first units at 12% above market without rehab and plans to sell select individual condos at 27% above purchase price.

Invested July 2020 with regular distributions above 8% cash-on-cash. With value-add in place and higher NOI, the asset recently re-valued at $10.6 million vs $7.3m purchase price with expected refinancing in September 2021 to return 100% of initial capital to investors.

Acquired late 2019 and post improvements, completed refinanced returning 112% of all costs in July 2021 at only 55% LTV.

Invested July 2021, 1330+ stabilized B class asset in fast-growing Houston market.

INVESTORS

Returning Investors

Please click here to enter Investors Portal

Please subscribe to our newsletter to receive:

- Preferred access to future Skytian investment opportunities

- Proprietary research and insights on general market and real estate trends

- Privileged access to live events and interviews with word-famous Investment Wizards

- VIP access to book events including entry to monthly draw to win free autographed copy of Ten

- Commandments of Investing

EVENTS & INSIGHTS

San Eng is a globally respected thought leader and teacher on business and investing. Besides his Wall Street Journal and USA Today best-selling book, Ten Commandments of Investing, San has given lectures and top business schools and taught the credit course Greed vs Fear as an Adjunct Professor at the prestigious Jiaotong University. He has sat on many corporate boards and advised the CEOs of dozens of growth companies. San regularly publishes his investment insights and is a highly sought-after speaker at conferences, podcasts, and educational events.

We share select insights from San and the Skytian team below:

- EXITED! Coconut Villas of Dunedin (Tampa): 60% IRR to investors in 2 years June 16, 2023

- Completed! 2nd cash out returning 154% capital, maintaining 100% ownership of cash-flowing property February 7, 2023

- $1.2-billion downtown St Pete project to benefit Satoshi Hideout and Elysium Apts February 1, 2023

- SkySights: Welcoming Year of the Rabbit with Open.AI! January 25, 2023

- Freddie Mac: 2023 Multifamily Outlook January 25, 2023

- A week in Tampa filming Real Estate Kings with Grant Cardone January 17, 2023

- San Eng at Family Office Forum NYC: we need more flex leasing to help solve housing crisis November 11, 2022

- San Eng at Family Office Forum: what is Branded Furnished Flex Leasing? November 11, 2022

- EXITED! Oasis Clearwater 43% gross IRR, 1.8x gross equity multiple in 20 months November 8, 2022

- On TV! Satoshi is no longer in hiding – featured on Bay News 9! November 2, 2022

- Closed! Elysium Apts in St Pete (Tampa) appraised ~55% above purchase price! October 27, 2022

- San Eng to speak at IVYFON FAMILY OFFICE Forum Dallas Oct 25-26th October 20, 2022

- Inside St. Pete’s first crypto-themed boutique hotel October 18, 2022

- St Pete multifamily real estate networking & learning event Wed Oct 12th October 6, 2022

- San Eng to speak at Family Office Forum New York Sept 7-8th September 2, 2022

- SkySights (August 2022): Our view of the US real estate market: ignore FUD, focus on demand vs supply August 3, 2022

- Redfin: Riverside, Phoenix, Tampa amongst most susceptible to housing downturn – do you agree? August 2, 2022

- Satoshi Hideout wall art collection – please tell us what you think! July 30, 2022

- Where hides Satoshi? July 25, 2022

- The Elysium Apartments Webinar July 14, 2022

- San’s Birthday Post – The 4 Stages of Retirement June 18, 2022

- #10Cs to Financial Freedom via Multifamily – Talk Tonight 7pm EST June 14, 2022

- Priceless legacy projects June 13, 2022

- Mike Myers: Failure is just an early attempt at success May 17, 2022

- Satoshi Hideout on St Pete Catalyst April 30, 2022

- Is it time to prioritize financial literacy over other skills? April 30, 2022

- Book Fox on Commandment 7: Marathon the Winners April 30, 2022

- Tampa Bay Times: Satoshi Hideout project in downtown St Pete April 26, 2022

- “If you want the future to be good, you must make it so.” Elon Musk April 22, 2022

- Oasis at Ballast Point – Q122 Investors Update April 4, 2022

- SkySights (Mar 2022): Where Hides Satoshi? April 1, 2022

- Closed: Satoshi’s Hideout March 31, 2022

- Book Fox on Commandment 6: Be Patient, Be Bold March 28, 2022

- Ten Commandments of Investing (#10Cs) soon to be in Portuguese! March 21, 2022

- SkySights (Feb 2022): $1 to $53 million in 12 months February 28, 2022

- Book Fox on Commandment 5: Seek Religion February 28, 2022

- Oasis at Ballast Point; a 135-unit apartment in South Tampa February 16, 2022

- Finance Executive Meetup Hosted by Phillips Exeter Academy January 21, 2022

- Zillow: Tampa remains #1 best place to buy house in 2022 January 19, 2022

- Q4 Update: Oasis at Clearwater, Tampa Florida December 28, 2021

- Happy Holidays and Q4 Update from the Coconut Villas Team! December 16, 2021

- Skytian Year-End Celebration 2021 December 16, 2021

- Thanksgiving Message: the Scientific Link between Appreciation and Happiness & Success November 25, 2021

- Many lucky 8’s October 22, 2021

- Top 30 metros with fastest rising rents October 21, 2021

- Co-Star on US multifamily: market red-hot with 4 of top 10 markets in FL October 1, 2021

- The Magic of Mobile Home Park Investing – by Paul Moore September 22, 2021

- Mom’s Tesla dance, why we love Tesla, SpaceX and Elon September 16, 2021

- The Magic of Compounding with Jack and Sally September 10, 2021

- Buy a Hermes, profits to workforce housing September 10, 2021

- Foreign investors wake up to non-gateway real estate markets September 8, 2021

- M&M: USA multifamily apt outlook very positive September 7, 2021

- Shocking truth about future of multifamily September 7, 2021

- Goldman Sachs on family office investment highlights September 7, 2021

- Forbes names Tampa the #1 emerging tech city in USA September 1, 2021

- Foreign buyers – why residential real estate may have more wind under its wings August 3, 2021

- Bobby Lee on Bitcoin (CNBC) June 11, 2021

- WSJ #4 best-seller! February 14, 2021

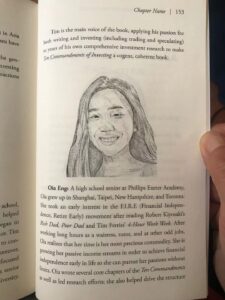

- A 17-year old’s investing journey – Will Smith interviews Oia Eng February 6, 2021

- Vital data for US real estate investors February 5, 2021

- Superbowl and investments talk w/ex Buc Brian Leonard and NFL friends on Clubhouse February 2, 2021

- My real estate mentor Tariq Sattar January 27, 2021

- Chat with Yonah Weiss real estate and cost-segregation expert January 3, 2021

- PWC on top US real estate markets December 19, 2020

- 8 million more Americans fall into poverty December 19, 2020

- The sinking city investment opportunity December 1, 2020

- The politics of tech – why it matters November 26, 2020

- Real estate will remain attractive safe asset class in foreseeable future November 26, 2020

- Tampa rental prices soar during pandemic November 26, 2020

- Tesla vs Non-Tesla November 25, 2020

- Cut Losses October 20, 2020

- Meet Mr. Market October 19, 2020

- Blair Hull: It Takes an Army to Time the Market October 15, 2020

- Commandment 6: Be Patient, Be Bold October 12, 2020

- The Road to 10,000 Hours October 10, 2020

- C10: Mind the Mind and Double Rainbows October 8, 2020

- Applying 10Cs to real estate investing October 1, 2020

- Select real estate markets remain great investments, safe from covid/recession September 28, 2020

- George Soros: Chaos Creates Opportunity September 27, 2020

- IOT – Independence of Thought – critical in investing September 26, 2020

- Jack Bogle: Play the Full Game to Win – Passive Investing September 25, 2020

- Alvin Wang Graylin: Expert in Virtual Reality and Artificial Intelligence September 16, 2020

- Ray Dalio’s one most important chart July 18, 2020

- Covid impact on agrifoods: 8 exciting investment themes with food/farming expert Dr. Evan Fraser April 16, 2020

- Dalio on what corona means for the global economy April 11, 2020

- Talk with Investment Wizard Victor Li April 10, 2020

- Soro’s investment principles sage advice in this time of crisis March 17, 2020

- Quest for the Holy Grail: High-Yield, Recession-Proof Investing in a Negative Interest Rate World (Part 1) March 11, 2020

- Ray Dalio on coronavirus and market March 5, 2020

- Berkshire’s annual letter 2020 – 2 observations February 22, 2020

- 28 jaw-dropping Chinese innovations February 12, 2020

- Genesis: FIRE Wizards January 8, 2020

- Is food humanity’s greatest challenge — and investment opportunity? January 1, 2020

- Blockchain needs more utility to justify its hype and drive adoption July 25, 2018

- Binance: the fastest profitable unicorn in history? May 18, 2018

- A professional investor’s attempt to demystify blockchain and crypto investments March 9, 2018

- ICOs not yet ready to disrupt the VC world November 20, 2017

- Should you invest in ICOs? Emphatic NO for 99.999% November 15, 2017

- Visit to 10 Downing Street to see PM David Cameron February 6, 2014

- San Eng’s Private Equity Firm named Top 30 in China January 10, 2014

- WSJ #4 best-seller!

- A 17-year old’s investing journey — Will Smith interviews Oia Eng

- Brad Sumrok on Old Capital

2020

- Real estate will remain attractive safe asset class in foreseeable future

- Tampa rental prices soar during pandemic

- The Magic of Compounding with Jack and Sally

- Kiyosaki: quit bitching and instead learn why rich don’t pay taxes

- Applying 10Cs to real estate investing

- Jack Bogle: Play the Full Game to Win — Passive Investing

- Select real estate markets remain great investments, safe from covid/recession

- Jeremy Grantham’s 10 Shakesperean rules of Investing

- Kathy Xu: cash reserves are king in crises (like now)

- Soro’s investment principles sage advise in this time of crisis

- Quest for the Holy Grail: High-Yield, Recession-Proof Investing in a Negative Interest Rate World (Part 1)

- Is food humanity’s greatest challenge — and investment opportunity?

2018 and earlier

GIVING BACK

The Why

Like Warren Buffet, we, too, tap dance to work. We invest in multifamily apt buildings that withstand economic cycles, that deliver steady cashflows and superior risk-adjusted returns. We are active investors – adding value to our properties by improving the apts and the surrounding communities. The rents we collect enable this winning formula for Skytian, our investors, partners, tenants, and the community.

#10Cs refers to the Ten Commandments of Investing, the Wall Street Journal, and USA Today best-selling book authored by San, Tim, and Oia Eng. Skytian is the primary supporter of Wizards Institute, an educational platform and companion site to the book, with the mission to educate novice and experienced investors on the smartest investing skills – e.g. the #10Cs. We do this via our proprietary research and exclusive interviews with the world’s greatest interviews accessible from our many media channels and our book.

All profits from the Wizards Institute and the book are donated to charities and educational groups that share our passion to promote financial education, particularly to the young and the underprivileged.