The Magic of Mobile Home Park Investing – by Paul Moore

September 22, 2021

What do Warren Buffett, Blackstone and Sam Zell (America’s top real estate investor) have in common?

They all love investing in mobile home parks (MHPs). In fact, for Zell, once one of the largest home owners in America, he sold it all and went all-in on mobile home parks, now owning over 150,000 parks in his REIT.

What do these Investment Wizards know that we don’t?

We ask our good friend, Paul Moore of Wellings Capital to share this once obscure real estate niche. Paul is a veteran real estate investor and has written several books on investing in multifamily, self-storage and now runs a fund focused on MHPs.

Like Paul, while we have yet to invest in MHPs, we understand and love investing to meet the demand/supply imbalance of workforce housing, earning stabilized cashflows and overall returns, with great tax benefits and debt AND helping to improve communities.

Please listen to San’s interview of Paul in the non-profit learning channel, Wizards Institute, here.

Would you like to learn more about MHPs? If so, we’d be happy to invite Paul back for a live session with Q&A – just let us know here.

The Magic of Mobile Home Park Investing

WizNews Post – Fall 2021

I hate investing in mobile homes.

I’m in my third decade as a real estate investor. I acquired four mobile homes as part of my portfolio over the years.

And they are among the worst investments I’ve ever made.

I talk with real estate investors all the time, and I consistently tell them: Don’t invest in mobile homes.

Now mobile home parks are quite a different story.

I love investing in mobile home parks. Mobile home parks are the best investments I have ever made. And others are catching this wave. Have you?

Mobile home parks surge in popularity

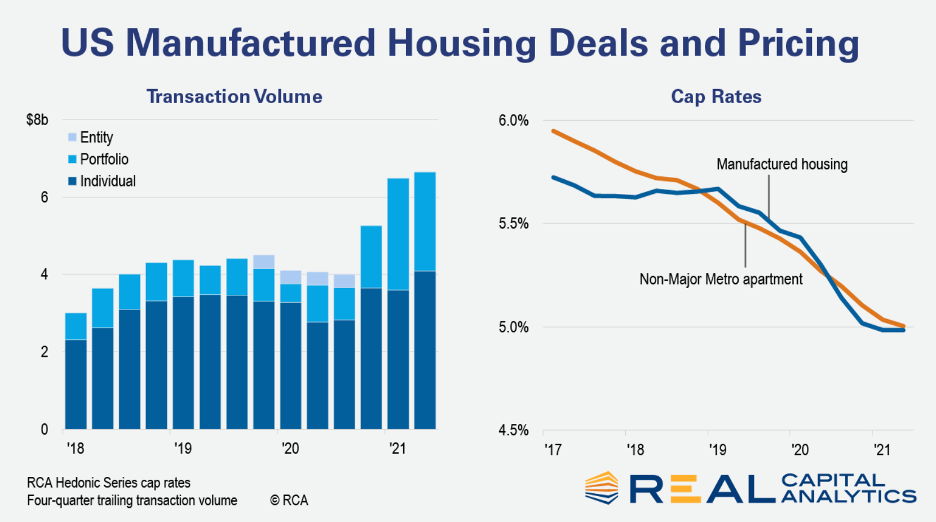

Many of America’s top investors are flocking to mobile home parks (aka manufactured housing) for solid cash flow and appreciation. A new report by Real Capital Analytics (RCA) reveals three key mobile home park investment metrics:

- RCA reports on a 2021 JLL analysis showing manufactured housing sales volume was up over 32% from 2019 to 2020, even amidst Covid. Twelve-month sales from Q3 2020 through Q2 2021 increased 48% over the prior four quarters with sales 30% higher than the previous peak in 2017.

- Pricing on manufactured housing has now increased to match multifamily pricing for apartments outside of the six major metro areas. The cap rates for both asset types are tied at 5.0% as of Q2 2021.

- Institutional purchases accounted for 13% of sales from 2017 to 2019 but are up to 23% of transactions from 2017 to now. Institutional buyers like to buy manufactured housing in bulk with portfolios accounting for 83% of the total.

This August 31, 2021 graphic summarizes these three metrics:

Sam Zell, America’s top real estate investor, caught this trend decades ago. He has amassed a portfolio of over 150,000 mobile home park pads in his REIT, Equity Lifestyle Properties.

The world’s most famous investor, Warren Buffett, is also involved in manufactured housing. He owns Clayton Homes, the nation’s largest mobile home manufacturer. In addition, Berkshire Hathaway has 21st Mortgage, a top manufactured home lender, and Berkadia, a large mortgage company that lends to mobile home parks and various other asset types.

Blackstone is deeply involved in mobile home parks as well, with billions in their manufactured housing portfolio. Our firm invested with a fund manager who sold a prior portfolio to Blackstone and made a nice profit.

Why is this happening?

Here are 13 factors contributing to the rise in popularity of mobile home park investing.

- The stigma of mobile home parks. Mobile home parks were the bottom of the barrel for years. So these overlooked and marginalized investments started lower and had further to rise.

- Supply and demand. Mobile home parks are the only asset type I know of experiencing increasing demand and decreasing supply annually. Zoning restrictions and other economic factors make building new parks nearly impossible. And there is a current backlog of six to twelve months to get a new mobile home.

- Affordable housing crisis. The affordable housing crisis is spreading to all age ranges. While 10,000 Americans turn 65 daily, six in ten don’t have $10,000 saved for retirement. Manufactured housing is a solution to many. The next step down is living under a bridge.

- Sticky tenants. Mobile home park tenants tend to stay for a long time. Since they usually own (or are buying) their homes, they have significant inertia to remain in place. The cost to move a mobile home is very high, and it isn’t practical for most tenants.

- A better living situation. Many tenants prefer having a yard, drive-up parking, their own deck, three bedrooms, and no thin wall between them and neighboring tenants. The pandemic has added more fuel to these factors.

- Lower cost per unit. Many large apartment complexes cost over $100,000 per unit. Mobile home parks typically cost a fraction of that, allowing the purchase of more units with lower cash and debt. This provides portfolio diversification. Speaking of debt…

- Favorable lending. Manufactured housing has among the lowest default rates in the commercial real estate realm. Lenders are eager to make loans, and Fannie/Freddie interest rates are in the 3% range these days. Interest-only periods and other terms are similar to multifamily.

8. Low maintenance. Mobile home park owners typically lease dirt. Tenants maintain their own homes, which contributes to several other benefits.

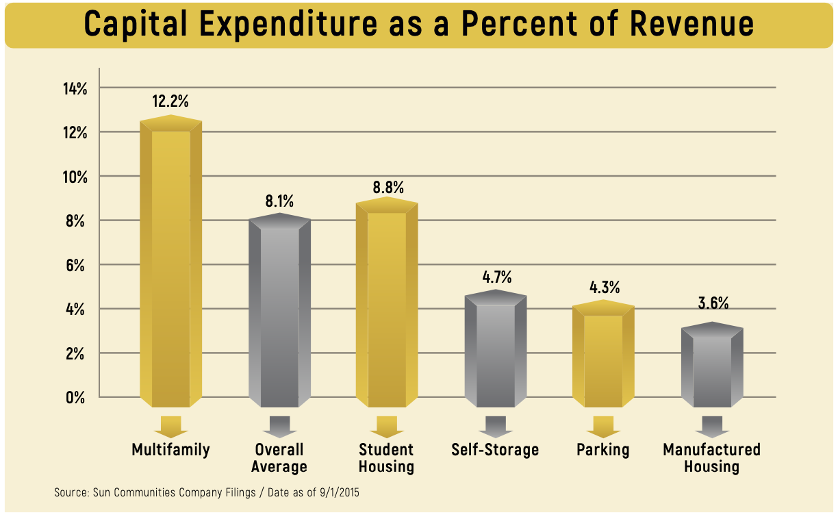

9. Low capital expenses. These expenses are low and quite predictable. Manufactured housing boasts the lowest capital expenses of the following five major asset types, at less than 30% of the CAPEX of apartments. Check it out:

10. Joint stakeholders. As mentioned, tenants and owners partner in this endeavor. This results in lower maintenance issues, increased pride of ownership, and far lower evictions.

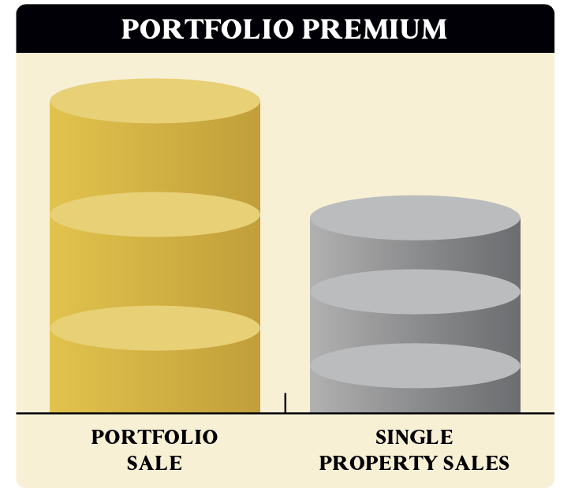

11. Portfolio premiums. Institutional buyers are looking for stabilized assets without a lot of drama and upgrades to perform. They are willing to pay a premium for a portfolio of assets.

12. Fragmented ownership base. This is my favorite issue in manufactured housing. For several reasons, including the stigma, mobile home parks owners are typically mom-and-pops. Single park owners who don’t have the knowledge or desire or resources to make upgrades to increase income and maximize value. Compressed cap rates have already created significant appreciation for them, and all they must do to unlock this appreciation is to sell.

13. Tax benefits. One of the most surprising aspects of this asset type is the opportunity to create large paper losses deferring significant income taxes. I have math showing how mobile home park investors often have losses higher than 100% of their equity investment in year one. This benefit won’t last forever – it’s related to accelerated depreciation allowed in the 2017 tax reform bill, and it will eventually phase out (but normal depreciation will still be strong).

How do investors get access to mobile home parks?

I am in my third decade as a real estate investor. I have concluded that to do this right, we either need to go all-in or invest passively.

Going all-in means focusing all our time, talents, and team on actively managing a commercial real estate asset. This would mean assembling an experienced team and giving it relentless focus. Don’t take on an investment this large in your spare time. And trying to split your time between a full-time career or retirement and a significant side investment is not twice as hard. It’s 20 times as hard. And it may not produce the results you’d like to see.

Investing passively is another story. It still takes a lot of effort, but this effort is concentrated upfront in the arena of operator due diligence. It is critical to find the right operator with a stellar track record, team, and acquisition pipeline to invest with.

Finding the right operator is like investing in Berkshire Hathaway or Apple or Amazon years ago. It takes effort and foresight on the front-end, but investors can then sit back and let the pros do the hard work for years to come. And unlike stock investors, real estate investors get pass-through benefits (like paper losses) from depreciation and other tax regulations in this arena.

There’s never been a better time to passively invest in commercial real estate. Rules from the 2012 JOBS Act opened the door for a significant increase in real estate syndication and crowdfunding. Social media and other online avenues provide meaningful access to reviews on syndicators and funds, so investors have more access than ever to a broad variety of investments in an assortment of asset types and operators.

Are you interested in learning more? WizNews is the right place to learn about real estate investing strategies and tactics. If you’d like to learn more about investing in mobile home parks, you can get my free mobile home park investing special report by visiting wellingscapital.com/resources today.

After a stint at Ford Motor Company, Paul co-founded a staffing firm where he was a two-time finalist for Michigan Entrepreneur of the Year. After selling to a publicly traded firm, Paul began investing in real estate. He founded multiple investment and development companies, appeared on HGTV, and completed over 100 commercial and residential investments and exits.

He has contributed to Fox Business and The Real Estate Guys Radio and is a regular contributor to BiggerPockets, producing regular live video and blog content. Paul also co-hosted a wealth-building podcast called How to Lose Money, and he’s been a featured guest on over 200 podcasts.

Paul is the author of The Perfect Investment – Create Enduring Wealth from the Historic Shift to Multifamily Housing as well as the forthcoming Storing Up Profits – Capitalize on America’s Obsession with Stuff by Investing in Self-Storage. Paul is the Founder and Managing Partner of Wellings Capital, a real estate private equity firm. Wellings Capital designates a portion of its profits to thwart human trafficking and rescue its victims.