Quest for the Holy Grail: High-Yield, Recession-Proof Investing in a Negative Interest Rate World (Part 1)

March 11, 2020

The author wishes to hear from other investors/thinkers on his two proposed solutions to the Investors Conundrum: how to invest safely ahead of the impending recession yet still generate high yields? He presents his first solution here — safe, passive Canadian mortgage lending that yields 8%-12%.

First Draft for Comments

Like many investors, I am dumbfounded by today’s historically low-interest rates. Major countries such as Japan, Germany, France, Switzerland already have negative interest rates. So instead of the banks paying you interest, they charge you for the privilege of depositing your hard-earned cash! While the USA and Canada are not negative — yet — the rates are so low they hardly keep up with inflation.

This has never happened in history — and it is truly terrifying.

Why? Well, retirees hoping to safely invest their savings are not only not able to retire from yields but rather seeing their Nest Eggs eroded by inflation. Parents like myself are scratching our heads on how to grow savings for kids’ art lessons and college tuition.

Many investors are still riding the quantitative easing (“QE”) cheap-money fuelled artificial asset appreciation e.g. equity markets. Experts much smarter than myself such as Ray Dalio do not believe QE is sustainable and will end very, very badly.

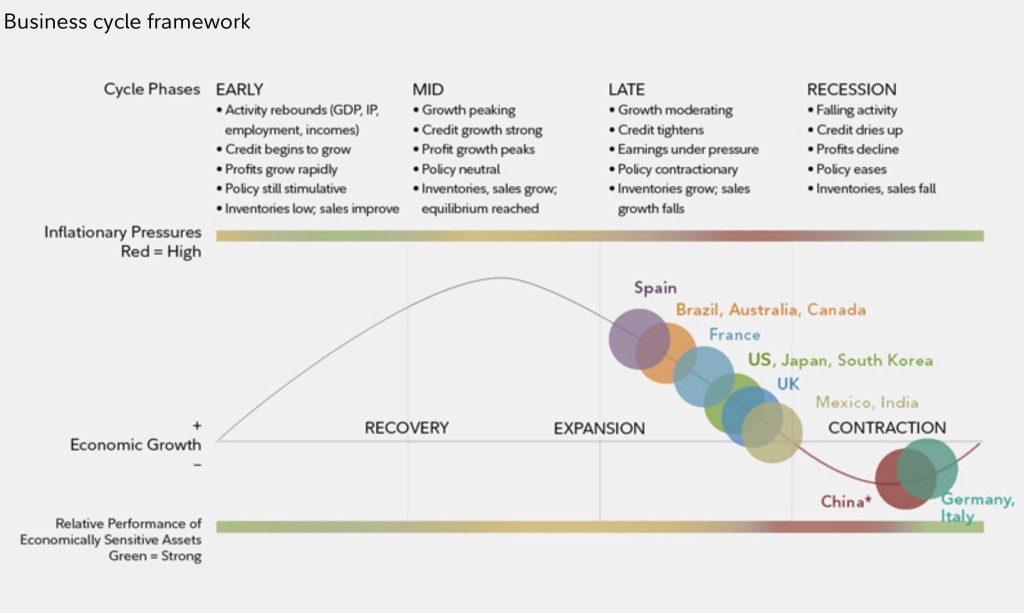

Moreover, there is near consensus amongst economists that we are at the tail end of the longest economic boom in history. No one can predict when the recession will come but almost everyone says it is inevitable. This gorgeous chart from Fidelity shows most major economies are already at the contraction stage.

As the manager of a family office, I have had the privilege to study and invest in a wide range of asset classes across Asia and North America: tech ventures, consumer growth firms, infrastructure projects, schools, hospitals, real estate, blockchain & crypto and of course, stocks. We have also invested in private equity, venture capital, and farmland funds. LOL, we have even invested in esoteric assets such as the largest horse-breeding firm in the world, and in insects — betting on amazing little critters called Black Soldier Flies.

[For fun: Why the black soldier fly could save the planet — Country Life, and my own article on how farming is linked to humanity’s biggest challenges, published recently in Family Office Magazine]

Digression aside, what is the solution to this unprecedented world for investors: looming global recession, low/negative interest rates eroding savings?

We have cross-crossed the globe in the past 5 years searching for the Investors Holy Grail: Safety + High Yields.

Alas, I believe we may have found it.

Not one, but two asset types that fit the bill.

In this article, we will explain the first asset — our love for Canadian mortgages.

First, we believe investing in Canadian mortgages is safe. Here’s why:

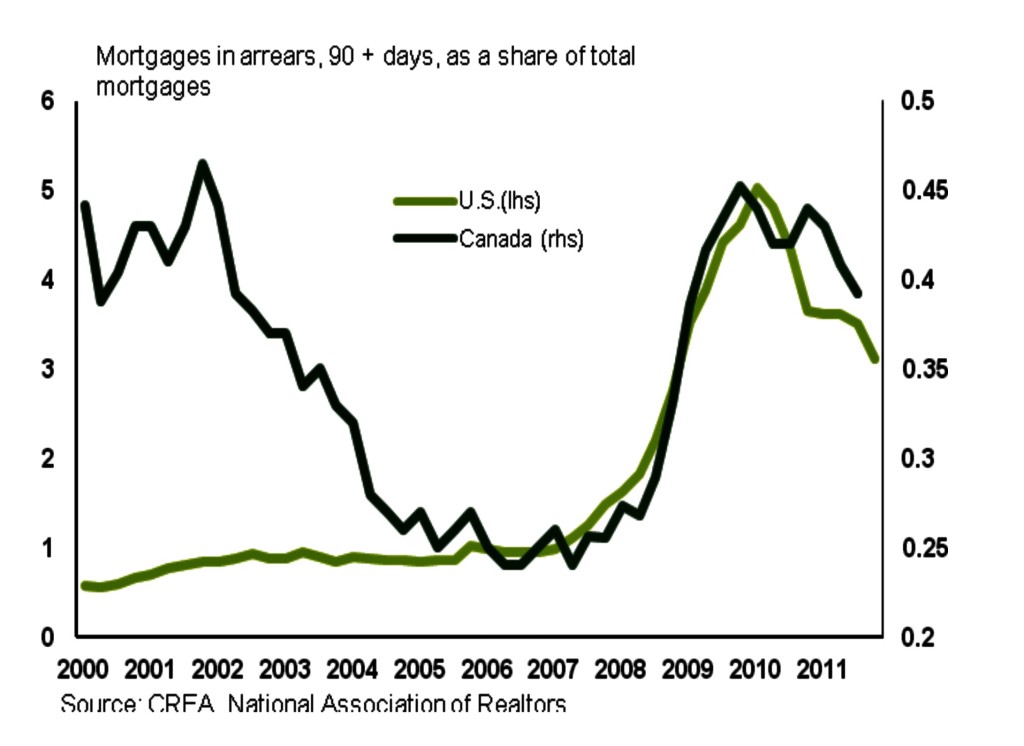

Do study the chart closely. The light green lines and left bar indicate overall mortgage default rates in USA. The dark green and right bars same, for Canada. You may note that while US defaults are in single digits historically, Canada mortgage defaults have never been higher than 0.5% — yes, less than half a percent or lower — or historically 8–10x lower than stateside. During the 2008 crash, the worst in recent history, USA defaults peaked at whooping 20%+ for subprime, yet Canada default never exceeded 0.45%.

Also, during the last five North American recessions, while overall USA housing prices dropped in three of them, in Canada, we believe, average prices stayed above water. (Will share data here soon)

Today, US mortgage market is healthy by historical standards, with default rates at 3.6%, according to CoreLogic. Canada, though is much safer — default rates are <0.25%. What’s more — lending to alternative borrowers (those that don’t qualify for the big banks) is at 1.9% — so, Canadian alternative lending default rates at 1.9% is even lower than overall USA 3.6% defaults.

Wow. Yes, wow, but why?

You’ve been patient. Let’s jump ahead and share the punch line.

Due to Canada’s tight bank and lending market, there is a sizable and growing CAD$13-$14 billion dollar alternative mortgage lending market.

There are hundreds of Canadian lending institutions and mortgage funds that lend to alternative borrowers at 8%-12% (first mortgage) and even up to 15%-17% (second/third mortgages) interest. Savvy investors that can find and invest in the best funds can enjoy 8%-10% net yields investing passively.

We are invested in a handful of these great fund managers for such yields, with average loan-to-value (LTV) ratios of <70% and primarily in first mortgages. Our mortgage portfolio is concentrated in the Ontario area, where defaults are materially lower — and safer than the national average of 1.9% for alternative lenders.

Thus, we sleep well at night, earning 8%+ yields passively knowing our capital is safe.

Ok, let’s get to the why. There’s no free lunch, right? Why so safe, yet such high yields?

The “secret” is the USA banking system favors the borrower, while Canada favors the creditor. Here are the major differences:

1) Unlike the USA, Canadian borrowers cannot claim mortgage interest tax deductions so no incentive to overborrow

2) Unlike the USA, there is no such thing as a 30-year fixed mortgage in Canada; they are all 5-years amortized over 25 years and the balance must be refinanced at 5 years so exposes borrowers to rate increases

3) No non-recourse loans in Canada (except Alberta)

4) The Canadian government requires banks to keep loans on balance sheets, rather than securitize it as in the USA so no craziness. During the 2008 housing crisis, 40% of USA mortgages had been securitized whereas Canada never exceeded 3%.

For further details, please refer to this LA Times article.

Nonetheless, high yields = high risk, right? We agree generally and almost true. We see this opportunity as unique. Currently, alt lenders account for about 7% in dollar terms of the overall Canadian mortgage market. These alt lenders are a diverse lot, some fly-by-nights with few million under management, some with decades of history, negligible or no losses over decades and billions managed. Many top funds are oversubscribed and do not take in new money as they adhere to strict lending standards to protect track records and reputation. So like investing in any asset class, the critical success factor is finding the one players to invest.

Given how conservative the Canadian lending market is, and the market overall is a 1.9% default rate and represents only 7% of the overall Canadian market. We would protect our assets by picking the best managers that represent well below the 1.9% average alt lender defaults and are still lending to safe borrowers and projects overlooked by banks.

We have spent the last two years vetting these top managers and negotiating the best terms and continue to do so.

In summary, we sleep like a cherub as we have invested in a diversified portfolio of Canada’s top mortgage funds, with LTVs <70% on primarily first mortgages concentrated in the healthiest Ontario region. Nationally, the alternative lending default is at <1.9% — our portfolio, even safer. Further, due to Canada’s conservative lending practices, they have never (*to double confirm) had any recession in history seeing housing prices dropped 30%. So with LTV <70% we would need to have a one-of-kind sustained and >30% housing downturn to be underwater.

There are of course no guarantees in life, but we do believe we have found the Holy Grail — or as close to it one can get.

End.

Thank you for reading. What do you think? Kindly share your comments, suggestions, concerns with us. Are we missing something — is this really a Holy Grail? Have you seen similar products in other parts of the world?